I owe enormous intellectual debts to Hyman Minsky and Augusto Graziani. But at one point, my “little knowledge” led me to believe, falsely, that they had both made a huge mistake in claiming that repaying debt destroyed money:

Graziani: As soon as firms repay their debt to the banks,

the money initially created is destroyed. (Graziani 1989)

Money is created as banks lend—mainly to business—and money is destroyed as borrowers fulfill their payment commitments to banks. (Minsky 1982)

This couldn’t be right, I thought: surely once banks had created money, they wouldn’t let it be destroyed? I considered cash loans in particular—surely the cash wasn’t destroyed on receipt, but put back into the vault for relending? This is why the model of money in my Debunking Economics (Keen 2011) is of a cash-lending bank, and not a modern electronic banking system, where loans are simultaneously matched by direct payments into deposit accounts.

Then I developed Minsky, the monetary modelling software that I named in honour of Hyman Minsky. I came to really understand double-entry bookkeeping, and realised that Minsky and Graziani were correct, and I was wrong. These days, money is primarily the sum of private bank deposit accounts. When you show modern bank lending and bank debt repayment in a double-entry table, it’s obvious that the former creates money, and the latter destroys it.

This points to a general rule about money creation and destruction: leaving aside cash loans, and direct government payments of cash to the non-bank public, to create money, an operation must increase both the Assets and Liabilities (or short-term Equity) sides of the banking system’s ledger. Conversely, this means that operations that occur exclusively on either the Assets side or Liabilities & Equity side neither create nor destroy money.

Having made this mistake myself, I came to realise that understanding double-entry bookkeeping is the “Holy Grail” to understanding money, and therefore that if someone makes claims about money that contradict double-entry bookkeeping (DEB for short), then they should be ignored, because they don’t know what they are talking about.

One person who fits this bill today is the founder of Progressive Money Canada, Jeff Eder. While he gets some parts of the money creation process right, he gets several others seriously wrong. This has led to an ongoing and fruitless dispute between Eder and advocates of Modern Monetary Theory.

Eder’s key contentions are:

-

That private banks create all the money in the economy (except for physical notes and coins), including the money spent by the government in excess of tax revenue and bond receipts:

- “The Government borrows money from commercial banks it has given the right to create money. That’s right! the Federal Government has given commercial banks the right to create money through the issuance of loans, and then borrows that money back at a rate of interest to finance deficits and the interest on its national debt. Conceptually that is the same as if I had the power to create money and gave that power to you, then borrowed money from you at interest.” (Eder, “How Is Money Creation Related To Our National Debt?“); and

- That the conventional belief that the government must “Tax and/or sell Bonds before it Spends”—which Kelton describes as (TAB)S) in The Deficit Myth—is correct. MMT asserts that (TAB)S) is false, and that the government “Spends first and Taxes And sells Bonds later”—S(TAB), to use Kelton’s acronym. (Kelton 2020: , pp. 27-29).

Both these claims stem from Eder’s failure to understand double-entry bookkeeping, and the dynamics of government financing.

Tell me you don’t understand DEB, without saying “I don’t understand DEB”

Establishing that Eder doesn’t understand double-entry bookkeeping is easy. The following quote is from his document CRF.PDF (which is attached to this post on Patreon—it’s very difficult to find where documents are located on his website):

When the federal government runs a budget deficit, to make up the shortfall it issues securities, bonds and treasury bills. When securities are first issued by the government, the BoC and commercial banks create new money the same way a commercial bank does when issuing a loan to you or me. (Emphasis added)

This is completely wrong: the actions he notes don’t create money, and are in no way comparable to how a commercial bank loan creates money—and it’s easy to show this using double-entry bookkeeping.

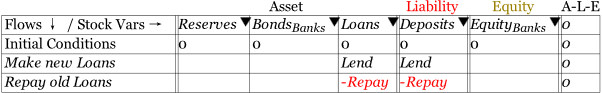

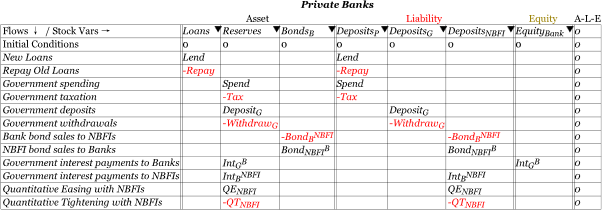

Figure 1 shows what bank loans and their repayment do. New loans add Lend dollars per year to the banking sector’s Liabilities of Deposit accounts, and Lend dollars per year to the banking sector’s Assets of Loans—thus creating both money and debt. Repayment of old loans remove Repay dollars per year from both bank Assets and bank Liabilities—thus destroying both money and debt.

Figure 1: Bank Loans create Assets and Liabilities simultaneously

Crucially, the general rule for money creation applies: Lend and Repay occur on both the Asset and the Liability side of the banking sector’s ledger. Therefore, the former operation creates money, and the latter destroys it.

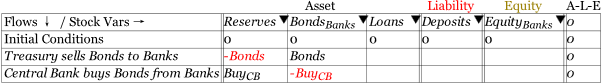

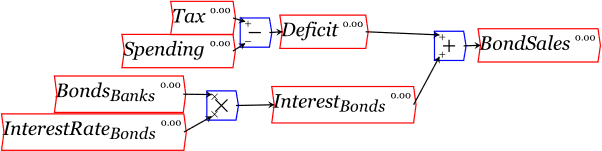

Figure 2 shows the operations that Eder says create money—the government issuing securities (selling them to Banks), and the Central Bank’s bond purchases of bonds from private banks (which I presume is the point of him mentioning the BoC in that quote). Both these operations happen only on the Asset side of the Banking Sector’s ledger, and therefore do not create money.

Figure 2: Treasury Bond sales to banks and Central Bank Bond purchases from banks

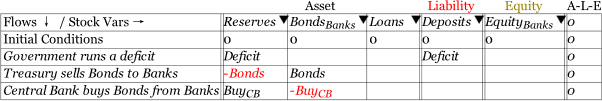

The government action which does create money, and which Eder misunderstands, is running a budget deficit, as shown in Figure 3.

Figure 3: Running a Deficit as well as selling Bonds

A deficit increases bank Deposits, which are Liabilities of the Banking Sector, and increases bank Reserves as well, which are Assets of the Banking Sector. Whatever Eder thinks is the causal sequence between taxes, bonds and deficits, deficits can’t be omitted from working out how money is created by the government. And it is the actual act of the deficit, not the taxation nor bond sales, which creates money.

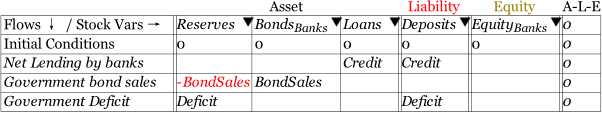

A generous interpretation of Eder’s statement is that he is asserting that bank loans create money in one operation—the addition of Credit dollars per year to the money supply, as shown in the first line of Figure 4—whereas bond sales do it in two steps: firstly, bonds are sold, then the government creates money by using the proceeds of the bond sales to run a deficit. This proposition is illustrated by the second and third lines in Figure 4.

Figure 4: Comparing bank loans to the public to banks buying bonds from the Treasury

Eder’s assertion that operations must occur in this order stem from his very literal reading of Canadian law and regulations. In the quote below, CRF stands for “the Consolidated Revenue Fund (CRF), at the Bank of Canada”:

The Federal Government raises funds in 3 ways, taxation, revenue from its Crown corporations, and by issuing securities. The proceeds from all 3 of these methods enters the CRF where a daily cash balance is maintained to meet the needs of Government spending. Money must be in the CRF before the Federal Government can spend. (CRF.PDF; emphasis added)

Eder’s assertion that “Money must be in the CRF before the Federal Government can spend” is completely true—and this supports MMT’s S(TAB) perspective, rather than Eder’s (TAB)S. Because in fact, sufficient funds are in the CRF before the deficit, as even a casual perusal of the Canadian Central Bank’s data shows: as of September 2022 (the date of this post), the CRF has roughly 100 billion Loonies in it.

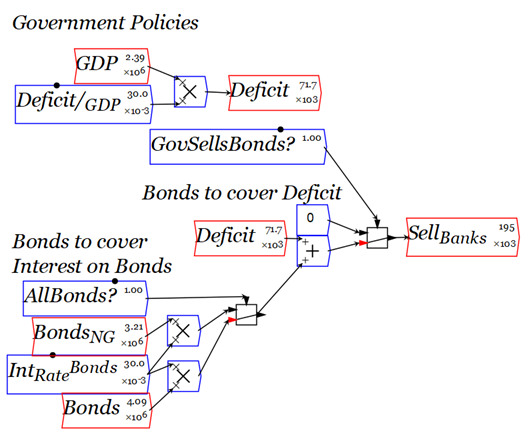

Practically, the bureaucrats who enforce the laws that Eder focuses upon are following a simple rule: given the net spending and interest-payment plans that the government currently has, issue sufficient bonds to cover this on a weekly (or even day-to-day) basis. Figure 5 shows this arrangement as a Minsky flowchart.

Figure 5: The bond sale planning process, shown as a Minsky flowchart

The requirements that Eder reads literally as meaning that spending (tomorrow) must be pre-financed by taxes or bond sales (today), in fact requires that bond auctions at a given time are matched to the expenditure scheduled for that time. This is already understood and acknowledged by MMT proponents. As Stephanie Kelton puts it in The Deficit Myth, where she describes reserves as “green dollars” and bonds as “yellow dollars”,

For more than a hundred years, the government has chosen to sell US Treasuries in an amount equal to its deficit spending. So, if the government spends $5 trillion but only taxes $4 trillion away, it will sell $1 trillion worth of US Treasuries. What we call government borrowing is nothing more than Uncle Sam allowing people to transform green dollars into interest-bearing yellow dollars. (Kelton 2020, pp. 41-42)

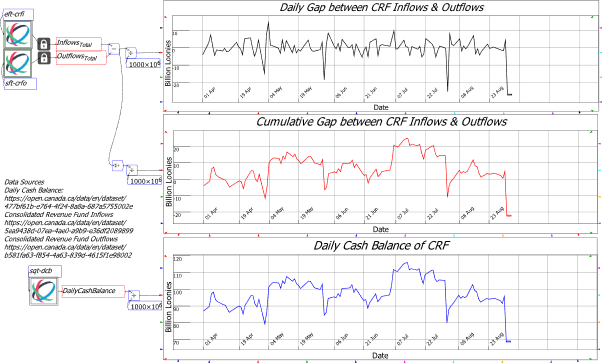

Bond sales are planned well in advance, based on estimates of future expenditures and revenues, and the real-time matching isn’t perfect—see Figure 5, which shows the gap between inflows and outflows, on a daily basis in the first plot, and cumulatively over the last six months in the second.

But there is absolutely no chance that these mismatches will turn the CRF negative: there is a huge buffer in the CRF itself, as the third plot in Figure 5 shows, which is roughly equal to the entire 2021-22 deficit. So, Canada could run a deficit of the same scale again in 2022-23, without a single bond issue, and there would still be funds in the CRF.

Figure 6: Inflows, Outflows, and the Daily Cash Balance of the Canadian Consolidated Revenue Fund (in Ravel©)

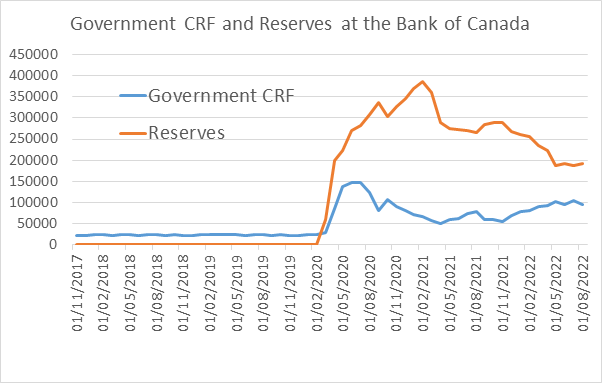

Furthermore, the Government could issue twice as many bonds as its deficit, and there would still be buyers, because the Reserve accounts of private banks at the Bank of Canada are currently twice as high as the Government’s CRF. This is admittedly an extraordinary circumstance—normally Reserves are very close to zero. But it is nonetheless a situation that is quite sustainable: it’s been going on for almost three years now.

Figure 7: The Government’s account and Bank Reserves as Bank of Canada Liabilities

As Figure 4 illustrates, banks buy bonds from the government using their Reserves. This raises two important questions that Eder fails to ask: where do Reserves come from, and are they money?

Reserves aren’t Money, and Government Bonds aren’t Debt

Money is the sum of the Liabilities (plus short-term Equity) of the banking sector, plus cash. Reserves are on the Asset side of the banking sector’s ledger, and they can’t be spent in the same way that money can. You can buy anything that is for sale with money. In contrast, there’s very little that banks can do with Reserves, apart from transfer them between each other, and buy government bonds with them. Since Reserves are not money, a better term for them is “funds”.

The key question is, since the Banking Sector uses Reserves to buy Government Bonds, where do they get these Reserves from—in other words, how are Reserves created?

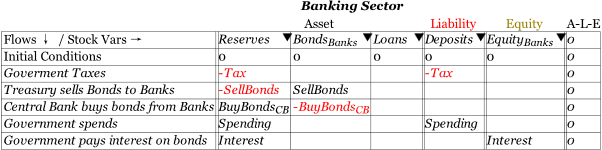

Figure 7 lays out the operations that create and destroy Reserves in (TAB)S order—Taxation first, then bond sales, and finally government spending, and the payment of interest on bonds. All these operations emanate from the government.

Figure 8: The operations of Taxing, Bond Sales, Government spending & Bond Interest payments in (TAB)S order

The negative entries for Reserves in Figure 5 are Tax, and SellBonds. The former destroys Reserves and Deposits, the latter swaps Reserves for Bonds of an equivalent value. The positive entries are BuyBondsCB, Spending and Interest. BuyBondsCB is financed by the Central Bank, Government Spending and Interest are financed by the Treasury.

Therefore, the funds that the banks use to buy government bonds are created by the government itself. It’s sheer semantics to describe this as the government borrowing from the banks, and it’s a failure of intellect to treat this—as both mainstream economists and Eder do—as equivalent to the private sector’s borrowing from banks. Instead, it’s an asset swap: the banks swap Reserves, which (normally) earn no interest, and can’t be traded, for Bonds, which do earn interest, and can be traded.

Why do both parties take part in this swap? For the banks, it’s a no-brainer: you swap a non-tradeable, non-income-earning asset for a tradeable, income-earning one. Here is a simple personal analogy for this situation:

Imagine that someone gives you $1 million, but says that you can’t do anything with it, because you’re holding it in trust for other people. Bummer!

But then the same person says “You can use this $1 million to buy bonds from me, on which I’ll pay you 3% interest, and you can spend the interest income as you wish.” Do you take the offer? You’d be an idiot not to! It turns a barren asset into one earning $30,000 a year for you.

But are you lending $1 million to the person who gave you the $1 million in the first place? No way: you’re converting his gift to you from a dead asset to a live one.

Therefore, the government isn’t borrowing “money”—or even “funds”—from the private banks when it sells bonds to them. Instead, it’s letting the private banks swap one asset, Reserves, which the government has created, for another asset—Bonds, which the government also creates—that is more valuable to the banks.

The banks obviously gain from this transaction, but what does the government get out of it? There are two benefits for it, one operational, the other social.

The social benefit is that, as badly as they have behaved in terms of pumping private debt (Keen 1995), private banks also maintain the payment system that is fundamental to the operation of a capitalist economy. It costs money to maintain this system: the bank accounts, the branches, the ATM machines, etc. Banks make some (a lot!) of money out of transaction fees, but these fees would be higher still if the banks only received non-income-earning Reserves because of government money creation. Interest-earning bonds compensate the banks, to some extent, for the costs of maintaining the payments system.

The operational benefit is that, without the bond sales, the Consolidated Revenue Fund would ultimately turn negative. Since the laws of Canada, and of almost all other countries, ban the Treasury from running an overdraft with the Central Bank, to conform with these laws, the Treasury must sell bonds to the banks. This, and not borrowing money from the banks to finance its spending, as Eder claims, is the primary function of government bond sales.

The dynamic bottom line

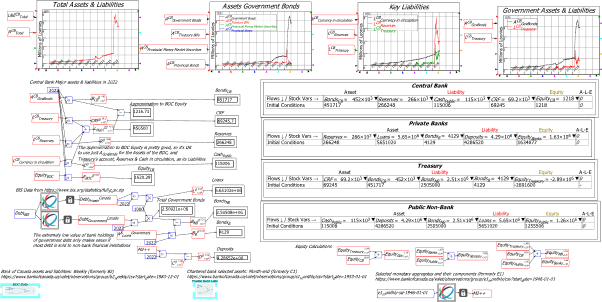

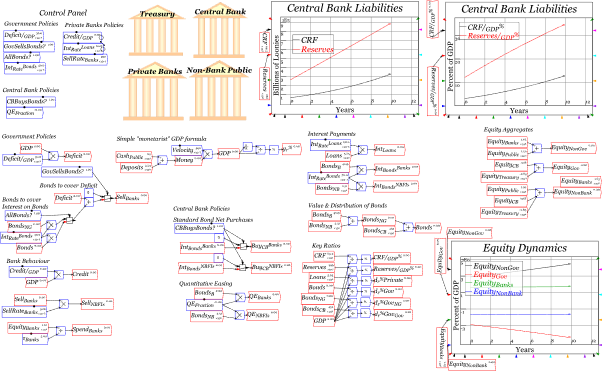

To see this properly, we have to see the entire financial system as an integrated whole—so I’ve built a simple Minsky model to illustrate the role of government bond sales. To keep this post focused on Canada, I’ve used a commercial extension to Minsky called Ravel© to extract data from the Bank of Canada and the Bank of International Settlements in 2022—see Figure 9.

Figure 9: The Ravel© file collating monetary data from the Bank of Canada and the BIS

This 2022 data then provides the initial conditions for a simple 8-Asset/Liability view of the financial dynamics of the Canadian economy. Those 8 Assets/Liabilities are:

- The CRF (69 billion Loonies; BOC data);

- Bonds owned by the Central Bank (451 billion; BOC data);

- Bonds owned by private Banks (4 billion; BOC data—this seems very low, but it’s what the BOC reports);

- Bonds owned by NBFIs, other non-banks, non-Canadian buyers, etc. (implied by subtracting BOC data from BIS data);

- Bank Reserves (226 billion; BOC data);

- Bank Loans to the non-bank public (5651 billion; BIS data);

- Bank Deposits of the non-bank public (4280 billion; BOC data); and

- Cash held by the non-bank public (115 billion; BOC data)

Figure 10: The initial conditions for the model, based on 2022 Canadian Data

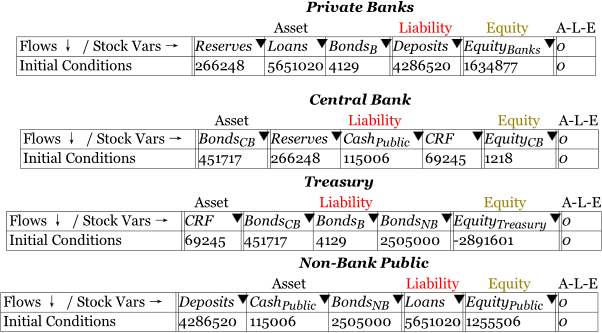

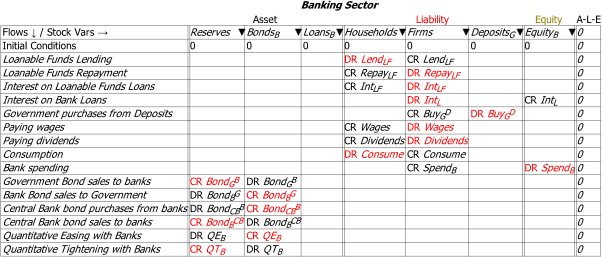

The model focuses primarily on government money creation and bond mechanics (though the modelling of private money creation is enabled too). The top table in Figure 11 shows the transactions in the Banking sector. The next three tables show the consequences of these transactions for the other sectors in the model: the Central Bank, the Treasury, and the Non-Bank Public.

Incidentally, Godley and Lavoie argued that every financial transaction must appear four times: twice for each of perspectives of the two entities involved in a transaction (Lavoie and Godley 2006). But in fact, in a fully integrated view of a monetary system, every transaction has to appear between four and eight times, depending on how many intermediaries it passes through. Welcome to octuple-entry bookkeeping!

Figure 11: The financial dynamics in this simple model

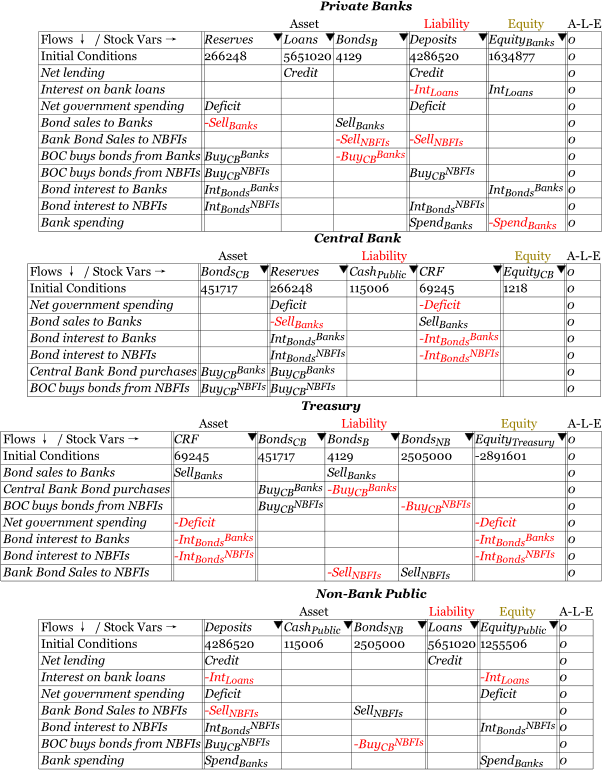

The part of the model that Eder thinks is not acknowledged by MMT—and is an “Achilles Heel” of government debt financing under the current banking system as well—is shown in Figure 12: the Treasury selling bonds equivalent to the deficit, plus interest on bonds, to the banks.

Figure 12: Government issuing bonds equivalent to the Deficit plus interest on all existing bonds

Not only is this actually acknowledged by MMT—as the quote from Stephanie Kelton indicates—it also is not an Achilles Heel, but a strength of the current system. As Figure 13 illustrates, the payment of interest on bonds actually creates Reserves (and adds to the CRF too, if the Central Bank net buys bonds from the banks and NBFIs).

The full (and still very simple) model is shown in Figure 13, in a run in which the Government runs a 3% of GDP deficit, issues bonds to cover the deficit and interest on all bonds (including those owned by the Central Bank, which the Treasury doesn’t have to pay interest on—but given Central Bank independence, the Treasury can’t know in advance whether the Central Bank will keep its bonds, sell them all, or buy yet more in QE, etc.), and in which the Central Bank’s net bond purchases were equal to the interest Treasury paid to Banks and NBFIs. Notice that these settings lead to rising Reserves and a rising Consolidated Revenue Fund.

There are many subtleties to the actual process of bond issuance and distribution that this simple model ignores (though a more sophisticated model could be built in Minsky fairly easily), but it indicates that what Eder and mainstream economists think is a problem for government finances is indeed a problem—but because it makes the CRF and bank Reserves rise too quickly! Interest payments on bonds add to bank Reserves, and the CRF rises because revenue from bond sales exceeds the outgoings (since some of the interest payments Treasury planned for weren’t made because the Central Bank bought some of the bonds on the secondary market).

Figure 13: The full model showing 3% of GDP deficit, bond sales, and Central Bank bond purchases from Banks and NBFIs

Eder’s concerns about government debt, and how deficits are financed, have the same root causes as the concerns of “Deficit Hawks” and mainstream economists: a failure to understand double-entry bookkeeping, and the fundamentals of the operation of a fiat currency.

Money Creating & Destroying Operations

Given the confusion that Eder’s intervention has added to an already confused debate—thanks to mainstream economists, who are one step worse that Eder, since he does understand private money creation—it’s worth using the general rule about money creation and destruction to clarify what actions do and don’t create (or destroy) money.

Leaving aside cash loans, and direct government payments of cash to the non-bank public, to create money, an operation must increase both the Assets and Liabilities (or short-term Equity) sides of the banking system’s ledger. Conversely, this means that operations that occur exclusively on either the Assets side or Liabilities & Equity side neither create nor destroy money.

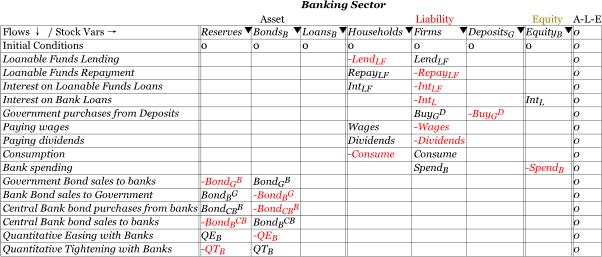

Applying this general insight clears up a lot of confusion about what does and doesn’t create money. Figure 14 shows some significant actions that create or destroy money—with operations that create money shown in black, and those that destroy it in red:

- Bank loans create money, and repayment destroys it;

- Government spending creates money, and taxation destroys it;

- Government deposits in government accounts with private banks creates money, and withdrawals destroy it;

- Sales of bonds to non-bank financial institutions (NBFIs) destroy money, and sales by NBFIs to banks creates it;

- Government interest payments to banks and NBFIs create money;

- Quantitative Easing (the Central Bank buying bonds) with NBFIs creates money; and

- Quantitative Tightening with NBFIs destroys it.

Figure 14: Operations that create and destroy money

Money or Asset Shuffling Operations

Conversely, Figure 2 lists economically significant transactions that don’t create money, because they either:

- Shuffle money between bank liabilities, or

- Swap one form of bank asset for another

Figure 15: Operations that do not create or destroy money

My debts to Minsky and Graziani

I’ll close by elaborating on my debts to Minsky and Graziani.

The former, with his “Financial Instability Hypothesis”, provided the first cogent analysis and criticism of capitalism that made sense to me. I’d read lots of Neoclassical and Austrian paeans to and Marxist critiques of capitalism, all of which fell flat with me, because the former presumed that capitalism tended to equilibrium, while the latter saw a tendency to stagnation. Minsky, in contrast, argued that capitalism had a tendency to booms, and that debt finance and the boom’s own dynamics were the causes of its periodic busts:

It follows that the fundamental instability of a capitalist economy is upward. The tendency to transform doing well into a speculative investment boom is the basic instability in a capitalist economy. (Minsky 1982, p. 67)

Having grown up in the boom years of the 1950s and 60s, Minsky’s analysis resonated with me. I resolved to build a proper mathematical model of his hypothesis, and this launched my academic career (Keen 1995).

The lesser-known Augusto Graziani gave me the profound logical insight into money that enabled me to work out how to model its dynamics properly:

In order for money to exist, three basic conditions must be met:

a) money has to be a token currency (otherwise it would give rise to barter and not to monetary exchanges);

b) money has to be accepted as a means of final settlement of the transaction (otherwise it would be credit and not money);

c) money must not grant privileges of seignorage to any agent making a payment.

The only way to satisfy those three conditions is to have payments made by means of promises of a third agent, the typical third agent being nowadays a bank. When an agent makes a payment by means of a cheque, he satisfies his partner by the promise of the bank to pay the amount due. Once the payment is made, no debt and credit relationships are left between the two agents. But one of them is now a creditor of the bank, while the second is a debtor of the same bank. This insures that, in spite of making final payments by means of paper money, agents are not granted any kind of privilege. For this to be true, any monetary payment must therefore be a triangular transaction, involving at least three agents, the payer, the payee, and the bank. (Graziani 1989, p. 3)

These insights enabled me to understand the dynamics of credit money creation, and they ultimately led to the development of my Minsky software.

Minsky, with its Godley Tables, is the first and only program to enforce the octuple-entry bookkeeping needed to understand how money is created, distributed, utilized, and destroyed. I recommend that anyone who wants to make informed comments on money creation download Minsky and its manuals and start learning how to use it.

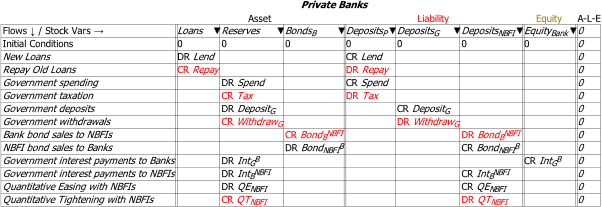

Appendix: Godley Tables using the accountant’s DR & CR convention

Minsky uses a simple + and – convention to label financial transactions, whereas accountants use the symbols DR and CR (Debt and Credit), with complicated rules about what is debited and what is credited. The accounting convention leads to a DR and CR pair on every line; Minsky‘s convention can lead to two pluses on one line (when the operation adds to Assets and Liabilities), or two minuses, as well as to plus and minus pairs. I find Minsky’s convention much easier to understand, but we also support showing transactions using DR and CR if desired.

Figure 16: Operations that create and destroy money

Figure 17: Operations that do not create or destroy money

References

Graziani, Augusto. 1989. ‘The Theory of the Monetary Circuit’, Thames Papers in Political Economy, Spring: 1-26.

Keen, Steve. 1995. ‘Finance and Economic Breakdown: Modeling Minsky’s ‘Financial Instability Hypothesis.”, Journal of Post Keynesian Economics, 17: 607-35.

———. 2011. Debunking economics: The naked emperor dethroned? (Zed Books: London).

Kelton, Stephanie. 2020. The Deficit Myth: Modern Monetary Theory and the Birth of the People’s Economy (PublicAffairs: New York).

Lavoie, Marc, and Wynne Godley. 2006. ‘Features of a Realistic Banking System within a Post-Keynesian Stock-Flow Consistent Model.’ in Mark Setterfield (ed.), Complexity, Endogenous Money and Macroeconomic Theory: Essays in Honour of Basil J. Moore (Cheltenham, U.K. and Northampton, Mass: Elgar).

Minsky, Hyman P. 1982. Can “it” happen again? : essays on instability and finance (M.E. Sharpe: Armonk, N.Y.).