Can we avoid another financial crisis?

In 2008, conventional economics led us blindfolded into the greatest economic crisis since the Great Depression. Almost a decade later, with the global economy wallowing in low growth that they can’t explain, mainstream economists are reluctantly coming to realise that their models are useless for understanding the real world.

How did mainstream economists not see the crisis coming? Was it unpredictable, as they now assert, or did their theory blind them to the real causes? Will another financial crisis occur?

These questions and others are asked and answered in Can we avoid another financial crisis? , a short (25,000 word) explanation for the lay reader of how we got into this economic mess, and why we are unlikely to get out of it.

In 2008, the USA and much of Europe walked blindfolded into the biggest economic crisis since the Great Depression. Almost a decade later, America appears to have recovered, but is plagued by tepid growth, despite the lowest interest rates in its history. Europe is split into a relatively prosperous North and a South that is mired in a Depression. Central Banks are experimenting with all sorts of abnormal policies (negative interest rates, “Quantitative Easing”) in an attempt to restore what they believe is normality. Bubbles are obviously afoot in several economies—notably China, Canada and Australia—and there is justified fear that they are about to burst. What will happen to the global economy when they do?

This short book (25000 words in 150 pages) explains how we got into this state, and considers whether we can get out of it. Its chapters are:

- From Triumph to Crisis in Economics

- Microeconomics, Macroeconomics and Complexity (sample chapter)

- The Lull and The Storm

- The smoking gun of credit

- The political economy of private debt

- A cynic’s conclusion

From Triumph to Crisis in Economics

“There was a time when the question this book poses would have generated derisory guffaws from leading economists—and that time was not all that long ago. In December 2003, the Nobel Prize winner Robert Lucas began his Presidential Address to the American Economic Association with the triumphant claim that economic crises like the Great Depression were now impossible:

Macroeconomics was born as a distinct field in the 1940’s, as a part of the intellectual response to the Great Depression. The term then referred to the body of knowledge and expertise that we hoped would prevent the recurrence of that economic disaster. My thesis in this lecture is that macroeconomics in this original sense has succeeded: Its central problem of depression prevention has been solved, for all practical purposes, and has in fact been solved for many decades. (Lucas, 2003, p. 1. Emphasis added.)

Four years later, that claim fell apart, as first the USA and then the global economy entered the deepest and longest crisis since the Great Depression. Almost a decade later, the recovery rom that crisis is fragile at best. The question of whether another financial crisis may occur can no longer be glibly dismissed…”

Microeconomics, Macroeconomics and Complexity

“I built a version of this model in 1992, long before the “Great Moderation” was apparent. I had expected the model to generate a crisis, since I was attempting to model Minsky’s Financial Instability Hypothesis. But the moderation before the crisis was such a striking and totally unexpected phenomenon that I finished my paper by focusing on it, with what I thought was a nice rhetorical flourish:

From the perspective of economic theory and policy, this vision of a capitalist economy with finance requires us to go beyond that habit of mind which Keynes described so well, the excessive reliance on the (stable) recent past as a guide to the future. The chaotic dynamics explored in this paper should warn us against accepting a period of relative tranquility in a capitalist economy as anything other than a lull before the storm. (Keen, 1995b, p. 634. Emphasis added)

Though my model did predict that these phenomena of declining cycles in employment and inflation and rising inequality would precede a crisis if one were to occur, I didn’t expect my rhetorical flourish to manifest itself in actual economic data. There were, I thought, too many differences between my simple, private-sector-only model and the complicated (as well as complex) real world for this to happen.

But it did…”

The Lull and The Storm

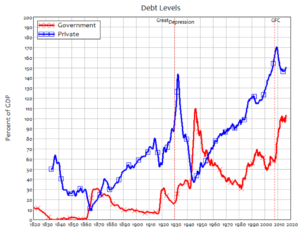

“In contrast to the orgy of self-congratulation in mainstream economics, alarms were being sounded by non-mainstream economists—and in particular by the English economist Wynne Godley (Godley and McCarthy, 1998, Godley and Wray, 2000, Godley, 2001, Godley and Izurieta, 2002, Godley and Izurieta, 2004, Godley et al., 2005). The key reason why Godley saw trouble looming was that he had developed a method to analyse the economy using inter-sectoral monetary flows. Godley applied the truism that one sector’s monetary surplus must be matched by an identical deficit in other sectors, to argue that the trend towards a US government surplus at the time required an unsustainable rise in private sector indebtedness…”

The smoking gun of credit

“You might wonder how economists trying to understand Japan’s sudden transition from economic powerhouse to economic basket case could miss as stark a piece of evidence as Figure 14. The reason is that they did not even consider this data when they went looking for clues. Their approach to sleuthing has more in common with Peter Sellers and his comic invention, the bumbling detective Inspector Clouseau, than it has with Sir Arthur Conan Doyle and Sherlock Holmes. By a series of plausible but false propositions, they have blinded themselves to the obvious…”

The political economy of private debt

“A similar fate is likely to befall the new Prime Ministers of Canada and Australia, Justin Trudeau and Malcolm Turnbull. Both countries will suffer a serious economic slowdown in the next few years, since the only way they can sustain their current growth rates is for debt to continue growing faster than GDP, as it is doing now: a 3.8% annual growth rate for Canada and 5.7% for Australia, versus nominal GDP growth of zero in Canada and 2% p.a. in Australia. This could happen, especially in Australia where its central bank could entice more leveraged property speculation, by dropping official interest rates from their outlier level of 1.5% p.a. to the near zero rate that applies in most of the OECD. But a continuation of this trend is highly unlikely, for two reasons…”

A cynic’s conclusion

“The scale of government spending needed to bring down private debt appears to be accepted only during crises like the Second World War. Money is, ultimately, our fragile means to mobilise existing resources and enable the creation of new ones, and when an existential threat arises, we forget money’s frailty and mobilise and create those resources directly: no-one in Britain in 1940 evoked “Sound Finance” as a reason not to build weapons, when the alternative was a German invasion. UK government debt rose by 44% of GDP in that one year, and from 220% to 340% of GDP over the course of the War. This indirectly enabled private sector debt to fall from 70% of GDP to 30%, thanks to the huge increase in public spending—and the rise in nominal GDP…”