The greatest disjuncture in the social sciences is between the image that economists have of their discipline, and its reality. A decade before David Graeber published Debt: the First 5000 Years (Graeber 2011), the future chief economic advisor to President George W. Bush published a paper with the confronting title of “Economic Imperialism” (Lazear 2000), in the discipline’s most prestigious journal, The Quarterly Journal of Economics. Lazear was not criticizing economics for attempting to take over other fields of social science, but lauding it for doing so:

There are two claims made in this essay. The first is that economics has been imperialistic, and the second is that economic imperialism has been successful. (p. 103)

This article is valuable, not for its insights, but for highlighting the rampant hubris of mainstream “Neoclassical” economics at the apogee of its influence. It opened with the declaration that “Economics is not only a social science, it is a genuine science” (p. 99). More than 40 pages and over 17,000 words later, it closed with:

Economics has been successful because, above all, economics is a science. The discipline emphasizes rational behavior, maximization, trade-offs, and substitution, and insists on models that result in equilibrium. Economists are pushed to further inquiry because they understand the concept of efficiency. Inefficient equilibria beg for explanation and suggest that there may be gaps in the underlying models that created them.

Because economics focuses so intently on maximization, equilibrium, and efficiency, the field has derived many implications that are testable, refutable, and frequently supported by the data. The goal of economic theory is to unify thought and to provide a language that can be used to understand a variety of social phenomena. The most successful economic imperialists have used the theory to shed light on questions that lie far outside those considered traditional. The fact that there have been so many successful efforts in so many different directions attests to the power of economics. (p. 142)

The paper’s length gives the clue that this was a solicited paper, intended to provide an assessment of the state of economics at the beginning of the new millennium:

To commemorate the end of one century and the beginning of another, the Board of Editors of the Quarterly Journal of Economics invited a select group of distinguished economists to submit articles assessing the accomplishments of the discipline of economics in the twentieth century. We have asked each of these scholars to reflect on “what we know that Marshall did not” in different areas of economics. (Editors 2000)

If ever a discipline deserved to be skewered, economics at the turn of the millennium was it, and David Graeber wielded the skewer with aplomb and humour. Economics is not a science, but a collection of self-referential and self-supporting myths, each of which cannot be dislodged without causing the entire edifice to collapse. Debt: The First 5,000 Years focused upon the myth that money sprung out of barter, and its attendant myth that the State and the Market are “diametrically opposed principles”, when in fact “they were born together and have always been intertwined”.

The evidence—the sort of thing on which a genuine science is based—that a society based upon barter has never existed is overwhelming. As David put it:

The story of money for economists always begins with a fantasy world of barter…

For centuries now, explorers have been trying to find this fabled land of barter—none with success…

missionaries, adventurers, and colonial administrators were fanning out across the world, many bringing copies of Smith’s book with them, expecting to find the land of barter. None ever did. They discovered an almost endless variety of economic systems. But to this day, no one has been able to locate a part of the world where the ordinary mode of economic transaction between neighbors takes the form of “I’ll give you twenty chickens for that cow.”

I never expected David’s well-documented evidence that barter-based societies were mythical to convince Neoclassical economists to abandon the myth, because without that myth, their entire paradigm unravels. But David’s work did strengthen the resolve of, and improve the analysis done by, the subsets of critical economists to which I belong: the Post-Keynesians, the Evolutionary Economists, the Biophysical Economists, and Modern Monetary Theorists. We frequently find ourselves referring to David’s work when we attack the myth of barter, and his work has also had a creative impact upon us.

In my case, David’s explanation of the origins of money in credit directly influenced my modelling the role of credit in economics. Building on David’s work, as well as that of radical economists like Joseph Schumpeter (Schumpeter 1934) Irving Fisher (Fisher 1933), Hyman Minsky (Minsky 1963; Minsky 1977, 1982), Basil Moore (Moore 1979), Augusto Graziani (Graziani 2003, 1989), and Wynne Godley (Godley 1999; Godley and Lavoie 2005), my colleagues Michael Hudson (Hudson 2009, 2004, 2020, 2024) Dirk Bezemer (Bezemer 2014; Bezemer 2011, 2010), Gael Giraud (Keen and Giraud 2016), Matheus Grasselli (Giraud and Grasselli 2019; Costa Lima et al. 2014; Grasselli and Costa Lima 2012) and I (Keen 2023; Keen 2021, 2015) have shown that credit plays an essential role in economics.

But neither our work, nor David’s, has influenced mainstream economics one jot. The last resort of the Neoclassical scoundrel is the argument that the fact that money didn’t evolve out of barter, but out of credit, is irrelevant: credit makes no significant difference to macroeconomics. Therefore, it’s easier to stick with the myth, and model capitalism as a barter system. Nothing of significance is lost.

This is how Neoclassical economists initially reacted to the Bank of England‘s startling admission in 2014 that the non-mainstream economists who asserted that bank lending—otherwise known as credit—created money, were correct, and the mainstream was wrong, in the paper “Money creation in the modern economy”:

The reality of how money is created today differs from the description found in some economics textbooks: Rather than banks receiving deposits when households save and then lending them out, bank lending creates deposits. (McLeay, Radia, and Thomas 2014, p. 14. Emphasis added)

You might think that, though economists could ignore one troublesome anthropologist, surely, they couldn’t ignore the Bank of England? I did too initially, but time proved me wrong.

Firstly, they disputed that the fact that bank lending creates money actually matters:

We establish a benchmark result for the relationship between the loanable-funds and the money-creation approach to banking. In particular, we show that both processes yield the same allocations when there is no uncertainty. In such cases, using the much simpler loanable-funds approach as a shortcut does not imply any loss of generality. (Faure and Gersbach 2022, p. 107; Faure and Gersbach 2017. Emphasis added)

Only a Neoclassical economist could write “when there is no uncertainty” and “does not imply any loss of generality” in the same paragraph…

Finally, they ignored the Bank of England completely.

When the Swedish Central Bank awarded its fake “Nobel” in Economics (Offer and Söderberg 2016) to Ben Bernanke, for a model of banking in which bank loans don’t create money, the so-called “Scientific Background” paper for his Prize did not even cite the Bank of England‘s contrary declaration about bank lending (Committee for the Prize in Economic Sciences in Memory of Alfred Nobel 2022).

David’s name was, of course, nowhere to be seen.

It would be futile, therefore, to expect economics to reform itself because of David’s exposé of the myth of barter. Instead, we should focus on David’s other gifts: the capacity to develop a realistic framework for understanding the world—such as his concept of “bullshit jobs” (Graeber 2018)— and to whimsically ridicule the absurd in the process.

The concept of “Bullshit Jobs” made intuitive sense to normal people, many of whom provided the materials for that book. But according to the Neoclassical theory that wages are based upon a worker’s “marginal product”, bullshit jobs could not exist, because the “marginal product” of a bullshit job is negative.

So then, how can we make sense of this obviously real phenomenon? Blair Fix argues, based on an empirically derived and supported hypothesis, that incomes are based not on the productivity of the individual, but on their rank in a hierarchy:

Neoclassical economists argue that the rich are different, because they are more productive… Marxists, in contrast, argue that the rich are different, because they exploit workers… What makes the rich different, I propose, is… their greater control of subordinates—what I call ‘hierarchical power’. (Fix 2020, p. 2)

This generates an incentive for the creation of bullshit jobs within a corporation, since the more people who report to a manager, the higher that manager’s status, and rank in a corporate hierarchy, will be. Bullshit jobs have nothing to do with productivity, and everything to do with power.

Similarly, I have developed a framework to show that credit is a critical aspect of a capitalist economy, by turning what Neoclassical economists think is their strength—mathematics—against them. Chronologically, this was done firstly by finding overwhelming empirical evidence that credit does matter; secondly, by developing a computer program—named after another great iconoclast, Hyman Minsky (Minsky 1982)—which enables a monetary economy to be modelled easily; and thirdly, by developing a mathematical proof that credit is indeed a fundamental determinant of economic activity.

I detail these here to show that key ripostes that economists make to many criticisms—that they lack empirical verification, that they cannot be modelled, and that they cannot be proved—are false. One has to be deliberately blind to the data to not see the impact of credit on the economy, credit can be modelled, but not within the Neoclassical paradigm—one must renounce it instead—and the logical proof that credit matters is irrefutable. This is why Neoclassical economists are so resistant to the well-founded wisdom in David’s work: admit David, and they have to exit themselves.

Credit: The Data

In rejecting Irving Fisher’s argument that the Great Depression was caused by a “debt-deflation”, Bernanke put “the counterargument”:

that debt-deflation represented no more than a redistribution from one group (debtors) to another (creditors). Absent implausibly large differences in marginal spending propensities among the groups, it was suggested, pure redistributions should have no significant macroeconomic effects. (Bernanke 2000, p. 24. Emphasis added)

Apart from the mischaracterisation of credit as “pure redistributions”, this is an empirical proposition, which could have been easily checked against data that existed when Bernanke made this claim. It was wrong then, and even more obviously today, with modern quarterly data on debt from the Bank of International Settlements (Dembiermont, Drehmann, and Muksakunratana 2013).

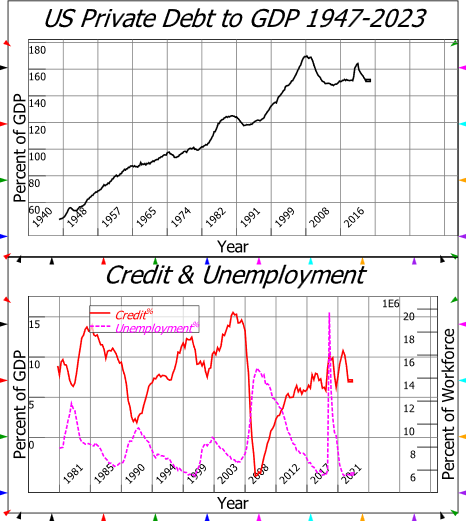

Figure 1 plots private debt from 1947 till 2023, and credit against the unemployment rate from 1981 to 2023, when the private debt level has exceeded 100% of GDP. The negative correlation between credit and unemployment is visually obvious, and in the period between 1990 and 2015—which covers the boom leading up to the 2007 “Global Financial Crisis” and its aftermath—the correlation exceeded -0.9: when credit rises, unemployment falls, and vice versa. Far from having “no significant macroeconomic effects”, credit is possibly the most significant of all of the determinants of macroeconomic performance.

Figure 1 Private Debt, Credit and Unemployment in the USA:

Empirically then, it is obvious that credit does matter. The remaining question is why does it matter? This is answered partially by comparing two models of banking: the Neoclassical model of “Loanable Funds”, in which banks are “mere intermediaries” which do not lend money, and the real-world model I call “Bank Originated Money and Debt”, in which, as the Bank of England says, “bank lending creates deposits”.

Credit: The Model

As the quote from Faure and Gersbach illustrates, in the Neoclassical model of banking, banks are “mere intermediaries” between savers and borrowers: they take in funds from savers and lend them out to borrowers.

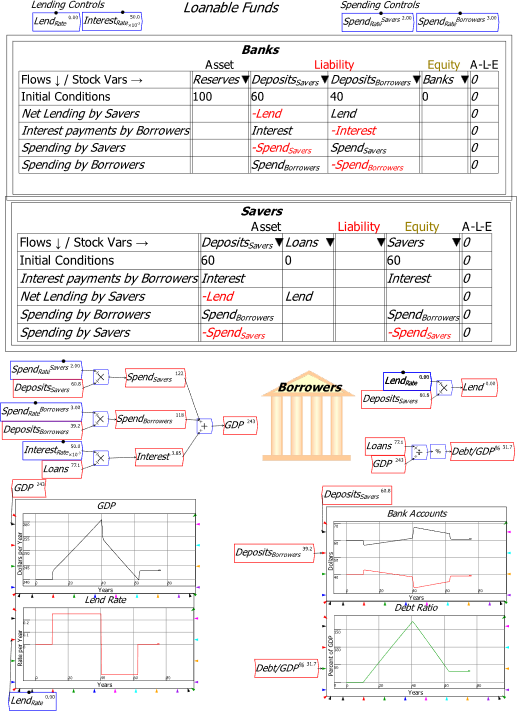

Figure 2 is a very simple rendition of this model: Savers and Borrowers have deposit accounts; they spend out of them at different rates, and the sum of their spending is GDP; and Borrowers pay interest to Savers (for simplicity, I have made the Banks neutral in this model).

Figure 2 shows a run of the model in which, starting in Year 10, Savers lending out 25% of their Deposit accounts every year, until such time as debt reaches 170% of GDP—the peak level of actual US private debt during the GFC. Then the control parameter LendRate is reversed, so that Borrowers pay off the equivalent of 25% of Savers’ deposit accounts every year.

The macroeconomic effect of these dramatic changes in Credit are minimal. There is a small effect of growing GDP as borrowers—who spend more rapidly than savers—take on more debt, and a small effect of falling GDP as borrowers repay debt, but it is relatively trivial: GDP rises from $240 per year at zero debt to $260 per year at a private debt level of 170% of GDP, and this is over a simulation time of seventy years. If this was all credit added to the macroeconomic equation, then it would be sensible to ignore it, as Neoclassicals do.

Figure 2: The Neoclassical “Loanable Funds” model of banking

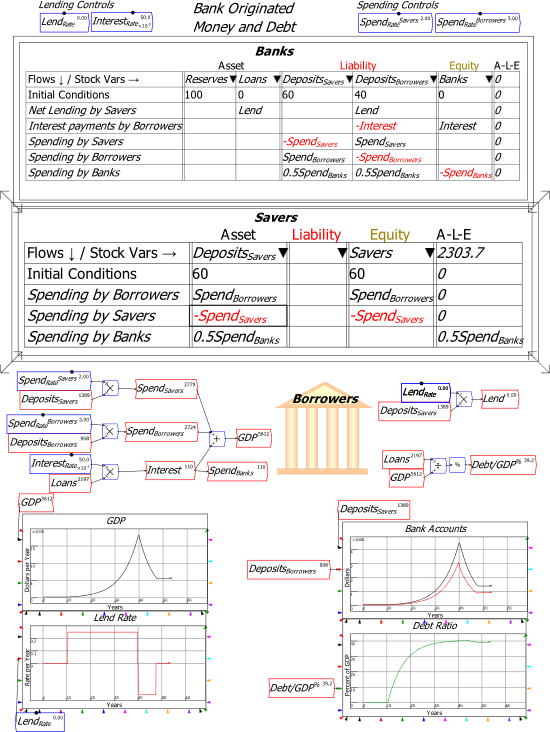

However, that is not the real-world. In the real-world, as the Bank of England declared, banks create money by issuing new loans. Figure 3 captures this, by showing Loans as an Asset of the Banks rather than of Savers. But otherwise, the model is identical to the Loanable Funds model in Figure 2.

However, the economic outcome couldn’t be more different: GDP grows virtually 100-fold over the 30 years of credit growth, and it falls dramatically as credit goes negative for the subsequent years.

Figure 3: The real-world model of “Bank Originated Money and Debt”

The model confirms that Credit matters, as the data itself showed. The next question—that Neoclassicals don’t even want to ask, let alone answer—is why?

Credit: The Proof

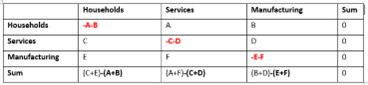

As the models indicate, credit has significant macroeconomic effects when bank lending creates money, but virtually no effect when banks are just conduits between savers and borrowers—as Neoclassical economists pretend that they are. The reason for this difference is easily shown using a device I call a Moore Table, in honour of the great pioneer of endogenous money research in economics, Basil Moore (Moore 1979, 1988; Moore 2006). A Moore Table lays out monetary expenditure and income in an economy in terms of expenditure flows between sectors (or people and companies) in the economy. Each row shows the expenditure by a given sector, and the sectors that are the recipients of that expenditure, with expenditure having a negative sign and income having a positive sign. Necessarily therefore, the sum of each row is zero.

Each column shows the net income of each sector. This can be positive (if income exceeds expenditure) or negative (if expenditure exceeds income), but the aggregate must again be zero.

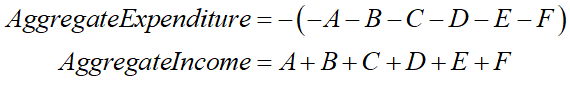

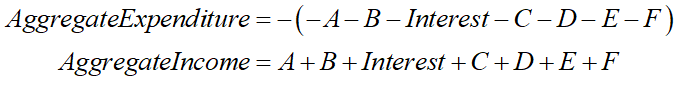

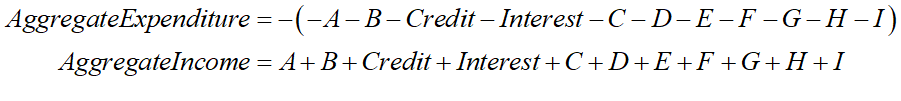

By construction, the negative of the sum of the diagonal elements of the table is aggregate expenditure, and it is identically equal to the sum of the off-diagonal elements, which is aggregate income. In the limit, if every agent in a country were included in the table, then it would measure that country’s GDP.

Figure 4 shows the simplest example, of an economy with money, but no credit or debt of any kind. Instead, there is a fixed stock of money, with each sector spending on the other two sectors.

Figure 4: Aggregate Expenditure and Income with no lending

Unremarkably, both aggregate expenditure and aggregate income are the sum of the flows A to F, as shown by Equation (1):

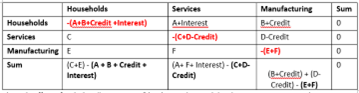

Figure 5 shows the Neoclassical model of Loanable Funds, and gives the example of the Services sector lending Credit dollars per year to the Household sector, and the Household sector then spending this borrowed money on the Manufacturing sector. The Household sector also has to pay Interest dollars per year to the Services sector, based on the level of outstanding debt. The transfer of money in the loan is shown across the diagonal, because only income-generating transactions are shown across the rows.

This model has Credit reducing the expenditure that the Services sector can do (you can’t spend money that you have lent to someone else), while increasing the spending that the borrower—the Household sector—can do. This additional spending by Households boosts the income of the Manufacturing sector, but it is precisely offset by the lower level of spending by the Services sector on Manufacturing (the flows A to F in this table do not have to be the same as in Figure 4).

This means that the entry for Credit cancels out on both the diagonal (aggregate expenditure) and the off-diagonal (aggregate income), so that Credit is not part of aggregate expenditure or aggregate income in Loanable Funds. Therefore, if Loanable Funds was an accurate description of what banks actually do, Neoclassicals would be correct to ignore credit, as they do in their macroeconomics.

Figure 5: Aggregate Expenditure and Income with Loanable Funds lending

The only effect of including “peer to peer” lending in this model is that Interest payments become part of Aggregate Expenditure and Income—see Equation (2).

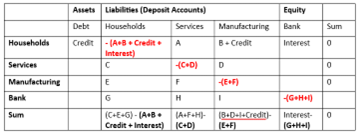

Figure 6 shows the real-world situation of bank lending. Credit adds to both the Assets of the banking sector, and its Liabilities—the deposit accounts of the Household sector. In this simple example, Household then spend this additional money on the Manufacturing sector. The logical and practical import of this situation is that Credit appears only once in both aggregate expenditure—the spending by the Household sector—and aggregate income—the income of the Manufacturing sector. Consequently, Credit does not cancel out, as it did for Loanable Funds.

Figure 6: Aggregate Expenditure and Income with Bank Originated Money and Debt lending

Instead, as Equation (3) shows, Credit is part of Aggregate Expenditure and Income. Given how volatile Credit is—as the US data in Figure 1 shows, it went from plus 15% of GDP in 2007 to minus 5% in 2009—it is the causa causans of macroeconomic instability. By ignoring it, Neoclassicals are modelling a system of petty commodity exchange, not real-world capitalism.

Therefore, empirical data and mathematics, the weapons that Neoclassical economists like to wield to intimidate other social sciences, can instead show that their paradigm is based on myths rather than science. Economics could be a radically different—and even useful—social science if it absorbed, rather than deflected, the criticisms that David made of it. But it never will, because the core elements of the Neoclassical paradigm are antithetical to the evolutionary foundations of genuine social sciences like Anthropology and Sociology.

Equilibrium as a Hallmark of Science?

Above all, the component of the Neoclassical paradigm that makes it impossible for it to be a genuine social science is the obsession with modelling the economy as if it is in equilibrium (Kornai 1971), or as if has an innate tendency to return to equilibrium after an “exogenous shock”. That concept, which Lazear thought was the hallmark of a science, is instead the mark of an intellectual dead end.

Ironically, the founders of the Neoclassical school of thought were aware of this. Jevons wrote in 1888 that:

The real condition of industry is one of perpetual motion and change. Commodities are being continually manufactured and exchange and consumed. If we wished to have a complete solution of the problem in all its natural complexity, we should have to treat it as a problem of motion—a problem of dynamics. But it would surely be absurd to attempt the more difficult question when the more easy one is yet so imperfectly within our power. (Jevons 1888, p. 93. Emphasis added)

Likewise, in predicting what their successors in the 20th century would achieve, John Bates Clark wrote in 1898—in an article entitled “The Future of Economic Theory”, which had a very similar genesis to Lazear’s—that:

The great coming development of economic theory is to take place, as I venture to assert, through the statement and the solution of dynamic problems… A static state is imaginary. All actual societies are dynamic; and those that we have principally to study are highly so. Heroically theoretical is the study that creates, in imagination, a static society. (Clark 1898, pp. 2, 9)

At the end of that century, while devotees like Lazear were exultant about their equilibrium-centric analysis, wiser heads were despairing. The mathematician John Blatt acerbically observed in 1983 that:

A baby is expected to first crawl, then walk, before running. But what if a grown-up man is still crawling? At present, the state of our dynamic economics is more akin to a crawl than to a walk, to say nothing of a run. Indeed, some may think that capitalism as a social system may disappear before its dynamics are understood by economists. (Blatt 1983, p. 5)

Blatt’s prescient remark predated the domination of economic modelling by what economists call Dynamic Stochastic General Equilibrium (DSGE) models, and lest an economist tell you that, therefore, this criticism is out of date, here is “Nobel” Prize winner Paul Romer on the topic of those very same models in 2016:

In the last three decades, the methods and conclusions of macroeconomics have deteriorated to the point that much of the work in this area no longer qualifies as scientific research … macroeconomic pseudoscience is undermining the norms of science throughout economics. If so, all of the policy domains that economics touches could lose the accumulation of useful knowledge that characteristic of true science, the greatest human invention. (Romer 2016, Abstract, p. 1)

Why has economics failed so badly? Arnsperger and Varoufakis provide a paradoxical but convincing argument that the very failures of Neoclassical economics are the source of its power. The failure to prove results they expected—driven primarily by the fact that, when put into dynamic form, the equilibria of their models almost always turned out to be unstable (Blatt 1983, Chapter 7, pp. 111-146)—led to arcane assumptions being added to hang onto their Holy Grail of Equilibrium, despite mathematics which proved that their God did not exist. Rather than causing the paradigm to undergo a desperately needed scientific revolution (Kuhn 1970), this led to the concept of equilibrium being turned into a quasi-religious belief about the innate nature of capitalism, using assumptions that are mind-bogglingly stupid.

However, since these stupid assumptions enabled economists, however tenuously, to hang on to the core beliefs of Marshall (Marshall 1890 [1920]), Jevons and Walras (Walras 1954 [1899]) that capitalism was a utility-maximising and cost-minimising system, and since these core beliefs corresponded to the ideological desires of society’s elite, this transformation of equilibrium from an unfortunate modelling compromise (Clark 1898; Jevons 1888) to the hallmark of a science (Lazear 2000) cemented the prestige of economics in the media and in social policy. As Arnsperger and Varoufakis put it:

such failure, instead of weakening neoclassicism, has reinforced its hold over the imagination of both the elites and the public at large. (Arnsperger and Varoufakis 2006, pp. 6-7)

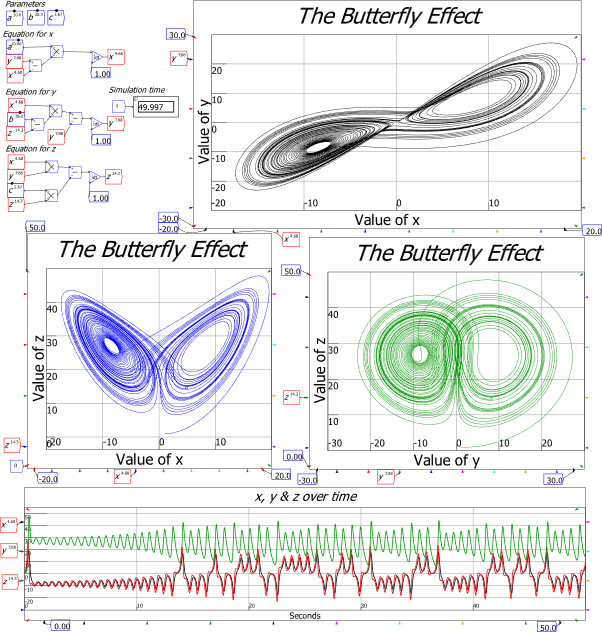

The resultant belief of today’s Neoclassicals—that a discipline which, in Lazear’s words, “insists on models that result in equilibrium” (Lazear 2000, p. 99)—is therefore a science is beautifully kyboshed by one of the most famous models in science, Lorenz’s “Butterfly” model of turbulence in fluid dynamics, which underpins modern meteorology (Lorenz 1963). With just three variables and three parameters, this model has three equilibria, all of which are unstable—see Figure 7. The three equilibria are obvious in the model: they are the point (0,0,0)—with the simulation beginning very nearby at (1,1,1,), after which it is propelled away—and the two “eyes of the mask”. Rather than being where the model “results in equilibrium”, equilibria are where the model will never be.

Figure 7: Lorenz’s “strange attractor” in which all 3 equilibria of this very simple model are unstable

Other pivotal works in post-WWII science show how ignorant economics is of what modern science is. Economics today is obsessed with deriving macroeconomics, the study of the whole economic system, from microeconomics, the assertions (false, of course) that Neoclassical economists make about the behaviour of consumers, firms and markets. Yet over 50 years ago, a real Nobel Prize winner (in Physics), P.W. Anderson, wrote the influential paper “More is Different”, in which he asserted, on the basis of Lorenz’s work and the understanding of complex systems that flowed from it, that what Neoclassicals are attempting to do is impossible. This is because, though reductionism is a valid scientific method (within limits), its obverse of “constructionism” is not:

Other pivotal works in post-WWII science show how ignorant economics is of what modern science is. Economics today is obsessed with deriving macroeconomics, the study of the whole economic system, from microeconomics, the assertions (false, of course) that Neoclassical economists make about the behaviour of consumers, firms and markets. Yet over 50 years ago, a real Nobel Prize winner (in Physics), P.W. Anderson, wrote the influential paper “More is Different”, in which he asserted, on the basis of Lorenz’s work and the understanding of complex systems that flowed from it, that what Neoclassicals are attempting to do is impossible. This is because, though reductionism is a valid scientific method (within limits), its obverse of “constructionism” is not:

The main fallacy in this kind of thinking is that the reductionist hypothesis does not by any means imply a “constructionist” one: The ability to reduce everything to simple fundamental laws does not imply the ability to start from those laws and reconstruct the universe… Instead, at each level of complexity entirely new properties appear, and the understanding of the new behaviors requires research which I think is as fundamental in its nature as any other… Psychology is not applied biology, nor is biology applied chemistry. (Anderson 1972, p. 393)

And neither, to continue Anderson’s hierarchy, is anthropology simply applied economics. In fact, a better strategy—in line with David’s method—would be to undertake an anthropological study of economics itself, to work out why this peculiar discipline has simultaneously become both so dominant and so dysfunctional.

Fortunately, there is work—of a fittingly satirical kind—to build upon, in the form of the non-orthodox economist Axel Leijonhufvud’s wonderful parody “Life Among the Econ”:

The Econ tribe occupies a vast territory in the far North. Their land appears bleak and dismal to the outsider, and travelling through it makes for rough sledding; but the Econ, through a long period of adaptation, have learned to wrest a living of sorts from it. They are not without some genuine and sometimes even fierce attachment to their ancestral grounds, and their young are brought up to feel contempt for the softer living in the warmer lands of their neighbours, such as the Polscis and the Sociogs.

Despite a common genetical heritage, relations with these tribes are strained—the distrust and contempt that the average Econ feels for these neighbours being heartily reciprocated by the latter—and social intercourse with them is inhibited by numerous taboos. The extreme clannishness, not to say xenophobia, of the Econ makes life among them difficult and perhaps even somewhat dangerous for the outsider. This probably accounts for the fact that the Econ have so far not been systematically studied. Information about their social structure and ways of life is fragmentary and not well validated. More research on this interesting tribe is badly needed. (Leijonhufvud 1973, p. 327)

In the spirit of David’s whimsical wit, my penultimate conclusion is expressed by correcting the errors in Lazear’s description of economics:

Economics has been successful because, above all, economics is a cult. Its dominant sect emphasizes rational behavior, maximization, trade-offs, and substitution, and insists on models that result in equilibrium, thus insulating itself from 20th century developments in genuine sciences. Economists are pushed to further irrelevance because they are obsessed with the concept of efficiency. Inefficient equilibria beg for dynamics and evolutionary explanations, and I suggest that there may be gaps in the brain wiring of economists who do not understand this.

Because economics focuses so intently on maximization, equilibrium, and efficiency, the field has derived many implications that are untestable, irrefutable, and frequently contradicted by the data. The goal of economic theory is to suppress critical thought and to provide a language that can be used to distort a variety of social phenomena. The most successful economic imperialists have used the theory to shed confusion on questions that lie far outside issues that they deludedly think they comprehend. The fact that there have been so many successful efforts in so many different directions attests to the capacity of economics to deceive.

My ultimate conclusion is a personal one. David began as an influence on my economic thinking when I first read Debt: the First 5000 Years in 2011 while working in Sydney. We became close friends when we met after I moved to London it 2014. That friendship became firmer still when his wife, the love of his life, and intellectual and artistic collaborator Nika Dubrovsky entered the picture.

Figure 8: David, myself, and his wife Nika Dubrovsky, in their home in London in December 2019

I had expected that we’d socialise, bounce ideas off each other, laugh, and collaborate for many years to come. But on September 2nd 2020, those expectations were dashed. Instead, I found myself writing a eulogy to him. It opened, as one does these days, with Tweets:

Oh David! @davidgraeber. . They say only the good die young, but why did you have to be one of them? There’s even more bullshit in the world now that you are no longer with us. It was a pleasure to know you, and it is a tragedy to say goodbye.

I’m an agnostic and so was David @davidgraeber. But if he’s doing anything at all right now, it’s an anthropological study of Heaven. Preceded by a brief study of Hell, but just for comparative reasons. The Devil was sad to see him go.

I’m agnostic, but for the very first time, I am wishing that there is life after death, I told @stacyherbert , when she wrote “He’s actually trending in America now on Twitter! I wonder if he would be mortified by that or laughing his ass off . . . I suspect the latter?”

So yes David, this fellow agnostic wishes he’s wrong, and I hope you can read this and are laughing at what a sentimental twat I’m being. And being jealous of me getting smashed on Tequila as I write this—though I suppose Heaven has much better Tequila than we get down here on the Purgatory that is Earth in 2020.

The only saving grace of David’s far-too-early death is the thought that at least he has missed seeing how much more of a purgatory life on Earth has become in the subsequent years.

Anderson, P. W. 1972. ‘More Is Different: Broken symmetry and the nature of the hierarchical structure of science’, Science, 177: 393-96.

Arnsperger, Christian, and Yanis Varoufakis. 2006. ‘What is neoclassical economics? The three axioms responsible for its theoretical oeuvre, practical irrelevance and, thus, discursive power’, Panoeconomicus, 53: 5-18.

Bernanke, Ben S. 2000. Essays on the Great Depression (Princeton University Press: Princeton).

Bezemer, D. J. 2009. ”No one saw this coming’ – or did they?’, Centre for Economic Policy Research (CEPR). https://voxeu.org/article/no-one-saw-coming-or-did-they.

———. 2014. ‘Schumpeter might be right again: the functional differentiation of credit’, Journal of Evolutionary Economics, 24: 935-50.

Bezemer, Dirk J. 2010. ‘Understanding financial crisis through accounting models’, Accounting, Organizations and Society, 35: 676-88.

———. 2011. ‘The Credit Crisis and Recession as a Paradigm Test’, Journal of Economic Issues, 45: 1-18.

Blatt, John M. 1983. Dynamic economic systems: a post-Keynesian approach (Routledge: New York).

Clark, John Bates. 1898. ‘The Future of Economic Theory’, The Quarterly Journal of Economics, 13: 1-14.

Committee for the Prize in Economic Sciences in Memory of Alfred Nobel, The. 2022. “Financial Intermediation and the Economy.” In. Stockholm: The Royal Swedish Academy of Sciences.

Costa Lima, B., M. R. Grasselli, X. S. Wang, and J. Wu. 2014. ‘Destabilizing a stable crisis: Employment persistence and government intervention in macroeconomics’, Structural Change and Economic Dynamics, 30: 30-51.

Dembiermont, Christian, Mathias Drehmann, and Siriporn Muksakunratana. 2013. ‘How much does the private sector really borrow? A new database for total credit to the private nonfinancial sector’, BIS Quarterly Review: 65-81.

Deutsche Bundesbank. 2017. ‘The role of banks, non- banks and the central bank in the money creation process’, Deutsche Bundesbank Monthly Report, April 2017: 13-33.

Editors. 2000. ‘Front Matter’, The Quarterly Journal of Economics, 115.

Faure, Salomon A., and Hans Gersbach. 2017. “Loanable funds vs money creation in banking: A benchmark result.” In CFS Working Paper Series. Frankfurt: Center for Financial Studies (CFS), Goethe University.

Faure, Salomon, and Hans Gersbach. 2022. ‘Loanable funds versus money creation in banking: a benchmark result’, Journal of economics (Vienna, Austria), 135: 107-49.

Fiebiger, Brett. 2014. ‘Bank credit, financial intermediation and the distribution of national income all matter to macroeconomics’, Review of Keynesian Economics, 2: 292-311.

Fisher, Irving. 1933. ‘The Debt-Deflation Theory of Great Depressions’, Econometrica, 1: 337-57.

Fix, Blair. 2020. ‘How the rich are different: hierarchical power as the basis of income size and class’, Journal of Computational Social Science.

Giraud, Gaël, and Matheus Grasselli. 2019. ‘Household debt: The missing link between inequality and secular stagnation’, Journal of Economic Behavior & Organization.

Godley, Wynne. 1999. ‘Money and Credit in a Keynesian Model of Income Determination’, Cambridge Journal of Economics, 23: 393-411.

Godley, Wynne, and Marc Lavoie. 2005. ‘Comprehensive Accounting in Simple Open Economy Macroeconomics with Endogenous Sterilization or Flexible Exchange Rates’, Journal of Post Keynesian Economics, 28: 241-76.

Gorman, W. M. 1953. ‘Community Preference Fields’, Econometrica, 21: 63-80.

Graeber, David. 2011. Debt: The First 5,000 Years (Melville House: New York).

———. 2018. Bullshit Jobs: A Theory (Simon & Schuster: New York).

Grasselli, M., and B. Costa Lima. 2012. ‘An analysis of the Keen model for credit expansion, asset price bubbles and financial fragility’, Mathematics and Financial Economics, 6: 191-210.

Graziani, Augusto. 1989. ‘The Theory of the Monetary Circuit’, Thames Papers in Political Economy, Spring: 1-26.

———. 2003. The monetary theory of production (Cambridge University Press: Cambridge, UK).

Hudson, Michael. 2004. ‘The Archaeology of Money: Debt versus Barter Theories of Money’s Origins.’ in L. Randall Wray (ed.), Credit and state theories of money: The contributions of A. Mitchell Innes (Edward Elgar: Cheltenham, U.K).

———. 2009. ‘Why the ‘Miracle of Compound Interest’ Leads to Financial Crises’, Ensayos de Economia, 19: 15-33.

———. 2020. ‘Origins of Money and Interest: Palatial Credit, not Barter.’ in S. Battilossi, Y. Cassis and K. Yago (eds.), Handbook of the History of Money and Currency (Springer: New York).

———. 2024. Temples of Enterprise: Creating Economic Order in the Bronze Age Near East (Dresden).

Jevons, William Stanley. 1888. The Theory of Political Economy ( Library of Economics and Liberty: Internet).

Keen, S. 2023. ‘The Dead Parrot of Mainstream Economics’, Real World Economics Review, 104: 2-16.

Keen, Steve. 2011. Debunking economics: The naked emperor dethroned? (Zed Books: London).

———. 2014. ‘Endogenous money and effective demand’, Review of Keynesian Economics, 2: 271–91.

———. 2015. ‘The Macroeconomics of Endogenous Money: Response to Fiebiger, Palley & Lavoie’, Review of Keynesian Economics, 3: 602 – 11.

———. 2021. The New Economics: A Manifesto (Polity Press: Cambridge, UK).

Keen, Steve, and Gael Giraud. 2016. L’imposture économique (L’ATELIER: Paris).

Kornai, J. 1971. Anti-equilibrium : on economic systems theory and the tasks of research (North-Holland: Amsterdam).

Kuhn, Thomas. 1970. The Structure of Scientific Revolutions (University of Chicago Press: Chicago).

Lavoie, Marc. 2014. ‘A comment on ‘Endogenous money and effective demand’: a revolution or a step backwards?’, Review of Keynesian Economics, 2: 321 – 32.

Lazear, Edward P. 2000. ‘Economic Imperialism’, Quarterly Journal of Economics, 115: 99-146.

Leijonhufvud, Axel. 1973. ‘Life Among the Econ’, Western Economic Journal, 11: 327-37.

Lorenz, Edward N. 1963. ‘Deterministic Nonperiodic Flow’, Journal of the Atmospheric Sciences, 20: 130-41.

Marshall, Alfred. 1890 [1920]. Principles of Economics ( Library of Economics and Liberty).

McLeay, Michael, Amar Radia, and Ryland Thomas. 2014. ‘Money in the modern economy: an introduction’, Bank of England Quarterly Bulletin, 2014 Q1: 4-13.

Minsky, Hyman. 1963. ‘Can “It” Happen Again?’ in Dean Carson (ed.), Banking and Monetary Studies (Richard D Irwin: Homewood).

Minsky, Hyman P. 1977. ‘The Financial Instability Hypothesis: An Interpretation of Keynes and an Alternative to ‘Standard’ Theory’, Nebraska Journal of Economics and Business, 16: 5-16.

———. 1982. Can “it” happen again? : essays on instability and finance (M.E. Sharpe: Armonk, N.Y.).

Moore, Basil J. 1979. ‘The Endogenous Money Supply’, Journal of Post Keynesian Economics, 2: 49-70.

———. 1988. Horizontalists and Verticalists: The Macroeconomics of Credit Money (Cambridge University Press: Cambridge).

Moore, Basil John. 2006. Shaking the Invisible Hand: Complexity, Endogenous Money and Exogenous Interest Rates (Houndmills, U.K. and New York: Palgrave Macmillan).

Offer, Avner, and Gabriel Söderberg. 2016. The Nobel factor: the prize in economics, social democracy, and the market turn (Princeton University Press: Princeton).

Palley, Thomas. 2014. ‘Aggregate demand, endogenous money, and debt: a Keynesian critique of Keen and an alternative theoretical framework’, Review of Keynesian Economics, 2: 312–20.

Romer, Paul. 2016. “The Trouble with Macroeconomics.” In.

Schumpeter, Joseph Alois. 1934. The theory of economic development : an inquiry into profits, capital, credit, interest and the business cycle (Harvard University Press: Cambridge, Massachusetts).

Walras, Leon. 1954 [1899]. Elements of Pure Economics (Routledge: London).