I’m not in the habit of writing retrospectives and expectations at the end of the calendar year, but the 2020s have necessitated paying attention to both hindsight and foresight. As I said in response to David Graeber’s untimely death in 2020, “Now we know why we speak of 20:20 vision, and 20:20 hindsight. We thought it was an ophthalmologist’s crazy numbering system. In fact, it was a warning from a time traveller.”

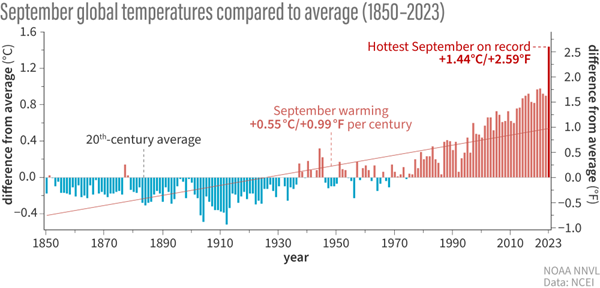

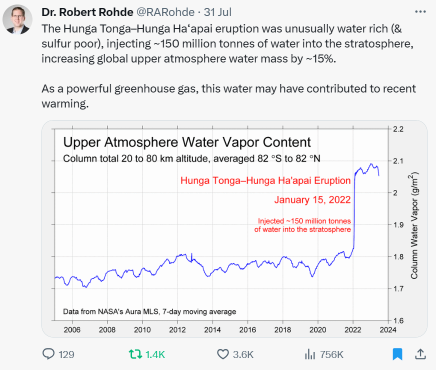

I subsequently described the 2020s as the “Hold My Beer” decade in my retrospective on 2021, “Saying goodbye to 2021 & hello to 2022, the 3rd year of the 2020s—the “Hold My Beer” Decade“. 2022 certainly delivered, with the Ukraine War adding to the miseries caused by Covid and mounting climatic disturbances around the world. 2023 has given us the Gaza Genocide, and the largest jump ever recorded in the global average temperature.

As bad as 2020, 2021, 2022 and now 2023 were, I’m frankly terrified at the thought of what 2024 will bring, and that fear comes from knowing and corresponding with some of the world’s leading climate scientists. We can only speculate as to what a global average temperature more than 1.5°C above pre-industrial levels will do to our food systems. Maybe we will be lucky in 2024, but it will only be luck than enables stable food supplies from now on.

The “fun” should start when the Northern Summer gets rolling. Though the Southern Summer still has two months to run, and it will doubtless have its unpleasant surprises, it’s the North that sets the political agenda for the planet.

One of the most troubling arguments I’ve seen is Paul Beckwith’s suggestion that the loss of Arctic summer sea ice could mean that Greenland, and not the North Pole, could be the centre of air circulation in the polar region. If that happens in 2024 then a 1,000km shift in weather patterns will wreak havoc on farming.

So, while I certainly won’t be cheering in the New Year, I’ll nonetheless celebrate surviving 2023 on New Year’s Eve night with my wife and some good friends here in Amsterdam. But despite the general gloom I feel, my 2023 was pretty good—very good in fact, since it finished with three more of the intellectual epiphanies that have blessed my academic life.

2023 didn’t start too badly either. The report I wrote in December 2022 for Carbon Tracker, “Rolling the DICE Against Pensions“, was finally published in July 2023 (Keen 2023; Keen and Hanley 2023). This gave me a means to put some teeth into my critique of the Panglossian nonsense that Neoclassical economists like William Nordhaus and Richard Tol have written. Sadly, humans are more likely to stress about their financial futures than they are about the viability of the ecosphere. Climate activists are starting to use the report to make pension funds know that they are potentially breaching their fiduciary duties by relying upon the work of economists to “safeguard” pensions. Instead, they are putting people’s pensions at jeopardy.

Shortly after that report was released, I began work at the Budapest Centre for Long Term Sustainability. It started badly, with my first dose of Covid starting 4 days after I arrived (I now wear my fancy mask in my office—my guess being that I caught Covid via the air conditioning, even though I’m the only person in my 80 sqm office). But it’s gone very well since.

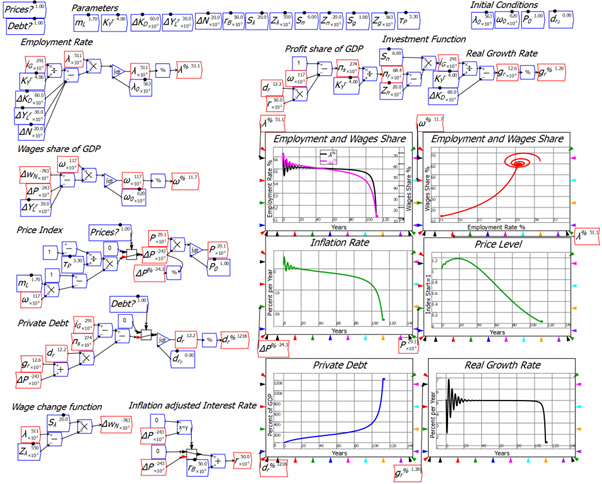

My responsibilities to BC4LS are to write (a) a 30,000 word book and (b) two 3,000 word blog posts. I had 90% of the book—now over 60,000 words in length—finished by the time I left Budapest to spend Xmas and New Year in Amsterdam. But there was still one difficult chapter not yet tackled: modelling price dynamics in a Minsky model. I cracked the core of that chapter—on pricing and inflation—on Friday.

The maths was quite simple in the end, and I lucked out with parameter values that illustrate the point I wanted to make: that while prices can work to stabilize a cyclical economy, in the presence of debt they can also lead to a debt-deflation. The next four figures show how this combination of factors plays out.

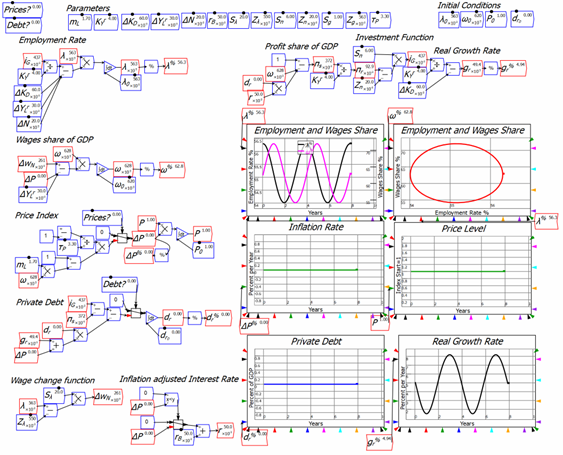

The simplest model, with no debt or prices, generates cycles of a fixed amplitude and frequency—Richard Goodwin’s classic growth cycle (Goodwin 1967).

Figure 1: A growth cycle model with no debt or price system

A model with prices shows price fluctuations leading the system to converge to equilibrium—which is the “magical” power of prices that so enamours our Neoclassical overlords.

Figure 2: The model with a price system but no debt

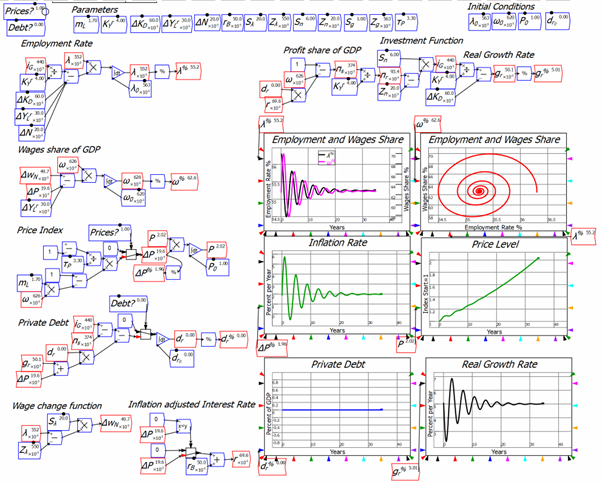

But our overlords ignore the role of private debt and credit in the economy, and when you include those, but not prices, you get a model which can experience a debt-crisis—though the simulation shown in Figure 3 has a borderline value for the key instability parameter (the slope of the investment function), so it gets locked in cycles rather than collapsing or converging.

Figure 3: The model with debt but no price system

When you introduce prices as well as debt, it initially appears that you get the best of both worlds: a rapid convergence to equilibrium and perfect cycle-free stability with growth at a rock solid 5% per year for decades.

However, behind the apparent equilibrium is a slowly rising level of debt, which comes at the expense of the workers—even though they do no borrowing whatsoever—as their share of income falls precisely as much as the share going to bankers rises. But you ignore that data, because you don’t think the distribution of income matters, you’re convinced that private debt is irrelevant to macroeconomics, and you’re obsessed with the rate of economic growth and its stability, which doesn’t waver an iota in 80 years. You proudly proclaim “The Great Moderation”, assert that your economic policies created it (Bernanke 2004b, 2004a), and sit back to wait for the “Nobel” to arrive.

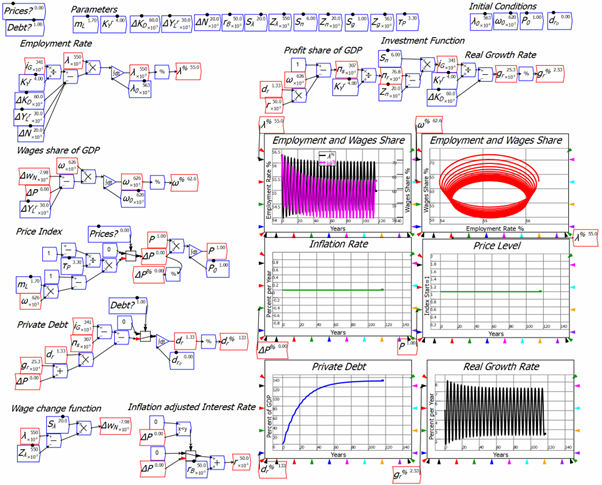

Figure 4: The model with both debt and a price system

Then suddenly, there’s a collapse: the long period of deflation has caused a slowly rising debt level, since falling prices increase the real burden of debt. The deflation accelerates, leading to an explosion in the debt to GDP ratio. As Irving Fisher put it so well almost a century ago in “The Debt Deflation Theory of Great Depressions“:

deflation caused by the debt reacts on the debt. Each dollar of debt still unpaid becomes a bigger dollar, and if the over-indebtedness with which we started was great enough, the liquidation of debts cannot keep up with the fall of prices which it causes.

In that case, the liquidation defeats itself. While it diminishes the number of dollars owed, it may not do so as fast as it increases the value of each dollar owed. Then, the very effort of individuals to lessen their burden of debts increases it, because of the mass effect of the stampede to liquidate in swelling each dollar owed.

Then we have the great paradox which, I submit, is the chief secret of most, if not all, great depressions: The more the debtors pay, the more they owe. The more the economic boat tips, the more it tends to tip. It is not tending to right itself, but is capsizing. (Fisher 1933, p. 344)

To be able to reproduce this brilliant insight in mathematical form, even with an exaggerated period of stability before The Crash, is a great delight to me. I’ve wanted to do this ever since I read Fisher’s poignant paper for the first time, way back in the 1970s, well over a decade before I first read Minsky—who also based his economics primarily on Fisher rather than Keynes.

So just this week, I’ve completed a set of ambitions that I’ve had since I first decided to pursue an academic career.

The ambitions didn’t all come at once, but rather sequentially, and though I doubted that I could achieve any of them, I ended up fulfilling all of them. They form a cohesive whole that are my approach to economics, and they’ll be spelt out in full—bar the very first topic of dialectical philosophy as a foundation for economics—in the book I’m writing for BC4LS, Rebuilding Economics from the Top Down.

The first was to show that Marx’s dialectical philosophy contradicted the Labour Theory of Value. I did that in my Masters thesis, which led to my first two refereed economics papers (Keen 1993a, 1993b). Next came modelling Minsky’s Financial Instability Hypothesis, which was the objective of my PhD (Keen 1995).

Then I wrote Debunking Economics (Keen 2001, 2011), largely as a gift to social activists who had been trying to achieve some equitable goal, and were blocked by economists who asserted that their goal wasn’t socially optimal. Without deep knowledge of economic theory, including the many logical fallacies and empirical absurdities on which it was based, these activists were made to look emotional and unscientific by economists—when in fact the economists were the ones living in a fantasy world.

I’d been in the same place, but I knew how to derail the economists, by pointing out that the intellectual foundations of their confident policy pronouncements were unsound, and I wanted to give other activists the same advantage.

I had no intention or expectation of contributing anything new to the many critiques of Neoclassical economics that already existed when I started writing the first edition in 2000. But when I was trying to explain why, according to Neoclassical economic theory, equating marginal cost and marginal revenue maximized profits, I spotted a contradiction between what was supposed to be profit maximizing behaviour for a monopoly—which worked at the aggregate level of the market—and for a “perfectly competitive” industry—which didn’t.

That led to a swathe of papers which annoyed the crap out of Neoclassical economists (Keen 2003, 2004b, 2004a, 2005; Keen and Standish 2005, 2006; Keen 2009; Keen and Standish 2010, 2015) and consumed several years of my intellectual life, until a paid commission as an expert witness on predatory lending took me back to my focus on financial instability, just before the Global Financial Crisis began (Keen 2007).

I was also dissatisfied with how I treated money in my model of financial instability—which was to model only debt, rather than money created by debt. Therefore, the next pressing desire was to work out how to model money properly, and the breakthrough came in 2005 (Chapman and Keen 2006). Though I am somewhat embarrassed by that paper today, it led ultimately to the development of Minsky.

That left “just” one major topic on my intellectual wish list: to work out the role of energy in production, since both Neoclassical and Post Keynesian production functions ignore energy completely. The insight that “labour without energy is a corpse, while capital without energy is a sculpture” (Keen, Ayres, and Standish 2019)—which occurred to me out of the blue—really did feel like something bestowed on me by a Santa Claus in academic dress.

I was more than content with that list of contributions, but writing this book for BC4LS has led to three more: a proof that the real-world profit maximization strategy is to sell as many units as possible; showing that the Cobb-Douglas Production Function is contradicted by energy data; and now this simple model of deflation amplifying a debt crisis.

So, even though 2023 has been a horrible year for the world, it’s been good to me.

In 2024, as for the last five years, my focus will be on exposing the nonsense that Neoclassical economists have written about global warming. It’s taken 4 years to go from realising that their banal damage predictions were based on empirical nonsense, to getting a major report out (Keen 2023) which is having some media impact (“When Idiot Savants Do Climate Economics“, “Economic models buckle under strain of climate reality“). But Neoclassical economists like Nordhaus will probably continue to be taken seriously on global warming until such time as the economy starts to fall apart because of it. I’m very pessimistic about the odds of policymakers and journalists realising that they’ve been conned until after it’s too late to do anything meaningful to reduce the damage.

Unless the Laws of Physics and Biology don’t apply to the economy, it’s only a matter of time before reality trumps the delusional expectations of economists. There’s no certainty that 2024 will be that year—and maybe there’s a natural explanation for the sudden jump in temperatures in 2023. But every year we continue on a business-as-usual approach brings closer the day when business-as-usual will no longer be possible.

On that cheery note, I’ll turn back to why this little model on price dynamics brings me such joy. Largely, it’s because Fisher was one of the first economists I read who hammered the point that equilibrium modelling of the economy is nonsense. That comes through in his description of the debt-deflationary process that I quoted earlier, but its scope is only apparent if you read the whole paper. His outline of why economists did not see the Great Depression coming begins with the error of assuming that equilibrium applies in the real world.

“CYCLE THEORY” IN GENERAL

1. The economic system contains innumerable variables—quantities of “goods” (physical wealth, property rights, and services), the prices of these goods, and their values (the quantities multiplied by the prices). Changes in any or all of this vast array of variables may be due to many causes. Only in imagination can all of these variables remain constant and be kept in equilibrium by the balanced forces of human desires, as manifested through “supply and demand.”

2. Economic theory includes a study both of (a) such imaginary, ideal equilibrium—which may be stable or unstable—and (b) disequilibrium. The former is economic statics; the latter, economic dynamics. So-called cycle theory is merely one part of the study of economic dis-equilibrium …

9. We may tentatively assume that, ordinarily and within wide limits, all, or almost all, economic variables tend, in a general way, toward a stable equilibrium …

11. But the exact equilibrium thus sought is seldom reached and never long maintained. New disturbances are, humanly speaking, sure to occur, so that, in actual fact, any variable is almost always above or below the ideal equilibrium …

Theoretically there may be-in fact, at most times there must be over- or under-production, over- or under-consumption, over- or under-spending, over- or under-saving, over- or under-investment, and over or under everything else. It is as absurd to assume that, for any long period of time, the variables in the economic organization, or any part of them, will “stay put,” in perfect equilibrium, as to assume that the Atlantic Ocean can ever be without a wave. (Fisher 1933, p. 337-339. Emphasis added)

Come Sunday, I’ll be raising a glass to toast Fisher, and Cantillon, Turgot, Quesnay, Marx, Schumpeter, Keynes, Goodwin, Minsky, and the many others who fought—unsuccessfully but valiantly—to drive fantasy out of economics, whose ideas moulded my approach to economics, and to whom, to some degree, I have repaid my intellectual debts.

Happy New Year everyone.

Bernanke, Ben S. 2004a. “The Great Moderation: Remarks by Governor Ben S. Bernanke At the meetings of the Eastern Economic Association, Washington, DC February 20, 2004.” In Eastern Economic Association. Washington, DC: Federal Reserve Board.

———. 2004b. “Panel discussion: What Have We Learned Since October 1979?” In Conference on Reflections on Monetary Policy 25 Years after October 1979. St. Louis, Missouri: Federal Reserve Bank of St. Louis.

Chapman, Brian, and Steve Keen. 2006. ‘Hic Rhodus, Hic Salta! Profit in a Dynamic Model of the Monetary Circuit’, Storia del Pensiero Economico: Nuova Serie: 137-54.

Fisher, Irving. 1933. ‘The Debt-Deflation Theory of Great Depressions’, Econometrica, 1: 337-57.

Goodwin, Richard M. 1967. ‘A growth cycle.’ in C. H. Feinstein (ed.), Socialism, Capitalism and Economic Growth (Cambridge University Press: Cambridge).

Keen, S., and Brian P. Hanley. 2023. “Supporting Document to the DICE against pensions: how did we get here?” In. London: Carbon Tracker.

Keen, Steve. 1993a. ‘The Misinterpretation of Marx’s Theory of Value’, Journal of the history of economic thought, 15: 282-300.

———. 1993b. ‘Use-Value, Exchange Value, and the Demise of Marx’s Labor Theory of Value’, Journal of the history of economic thought, 15: 107-21.

———. 1995. ‘Finance and Economic Breakdown: Modeling Minsky’s ‘Financial Instability Hypothesis.”, Journal of Post Keynesian Economics, 17: 607-35.

———. 2001. Debunking economics: The naked emperor of the social sciences (Pluto Press Australia & Zed Books UK: Annandale Sydney & London UK).

———. 2003. ‘Standing on the toes of pygmies:: Why econophysics must be careful of the economic foundations on which it builds’, Physica A: Statistical Mechanics and its Applications, 324: 108-16.

———. 2004a. ‘Deregulator: Judgment Day for Microeconomics’, Utilities Policy, 12: 109-25.

———. 2004b. ‘Improbable, Incorrect or Impossible? The Persuasive but Flawed Mathematics of Microeconomics.’ in Edward Fullbrook (ed.), A Guide to What’s Wrong with Economics (Anthem Press: London).

———. 2005. ‘Why Economics Must Abandon Its Theory of the Firm.’ in Massimo Salzano and Alan Kirman (eds.), Economics: Complex Windows (New Economic Windows series. Springer: Milan and New York: ).

———. 2007. “Deeper in Debt: Australia’s addiction to borrowed money.” In Occasional Papers. Sydney: Centre for Policy Development.

———. 2009. ‘A pluralist approach to microeconomics.’ in John Reardon (ed.), The Handbook of Pluralist Economics Education (Routledge: London).

———. 2011. Debunking economics: The naked emperor dethroned? (Zed Books: London).

———. 2023. “Loading the DICE against pension funds: Flawed economic thinking on climate has put your pension at risk ” In. London: Carbon Tracker.

Keen, Steve, Robert U. Ayres, and Russell Standish. 2019. ‘A Note on the Role of Energy in Production’, Ecological Economics, 157: 40-46.

Keen, Steve, and Russell Standish. 2005. ‘Irrationality in the neoclassical definition of rationality’, American Journal of Applied Sciences, Special Issue: 61-68.

———. 2006. ‘Profit maximization, industry structure, and competition: A critique of neoclassical theory’, Physica A: Statistical Mechanics and its Applications, 370: 81-85.

———. 2010. ‘Debunking the theory of the firm—a chronology’, Real World Economics Review, 54: 56-94.

———. 2015. ‘Response to David Rosnick’s “Toward an Understanding of Keen and Standish’s Theory of the Firm: A Comment’, World Economic Review, 2015: 130.